|

The Myth of Leverage (Novo Resources; NVO.V) A high-grade, defensive stock in the overvalued gold-equity sector

|

|

Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity whose performance has been similar. In retrospect, if you invested in gold, you not only made much better returns, you also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much below its cost of production. Moreover, depending on your jurisdiction, you might have paid a lower (or no) tax on owning gold.

I am often amused when investors talk about leverage that mining equities offer—a large proportion of investors in the mining sector are driven by this, a sort of casino mentality. As experience over the last 16 years shows, leverage has been a myth and has actually been negative. In their chase for leverage, investors missed out on value-investing and profiting from wealth-creation.

Let’s dissect this...

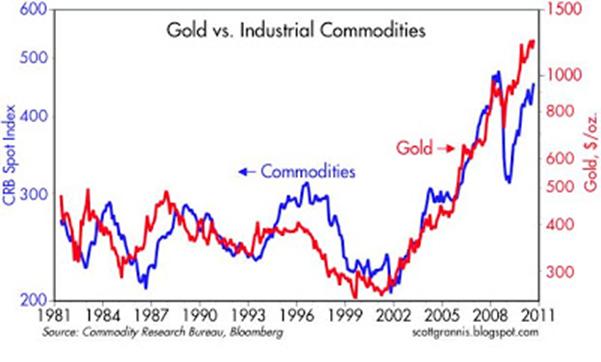

As you can see in the following three graphs, there is often a very close correlation between prices of commodities. This means that when a particular commodity goes up in price, other commodities go up as well. When the price of a certain metal increases, cost of its production increases as well as a consequence of the prices of commodities (iron, oil, etc.) that go as ingredients into production going up as well, leaving at best an uncertain, unpredictable leverage in the equation.

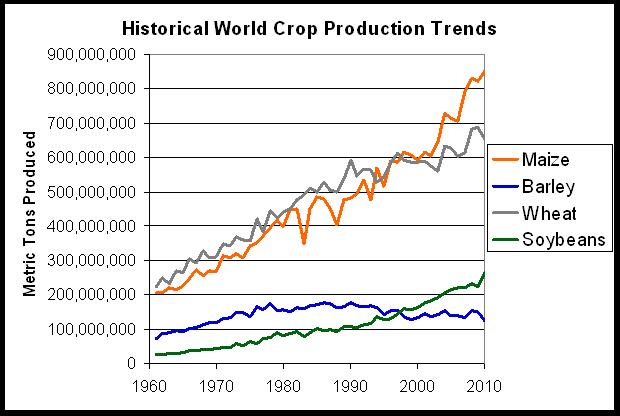

As the following graph—on how production of certain commodities has changed over the years—shows, the invisible hand of the market using profit signals ensures that the quantity of commodities produced changes at the margin (and eventually by a huge amount) as a result of continual price feedback ensuring that market pricing trend of most commodities stay similar.

I meet a lot of people who have very bullish opinions on their favorite commodity, which sometimes acts like a deity in their minds. They then invest without much due diligence on equities. Why should they when they think gold is going to US$5,000 and silver to $100 an ounce? In fact, they then often gravitate towards the worst project at current metal prices, but which seemingly offers a massive leverage.

The problem of course is that they forget to account for what would happen to the cost of production if gold and silver really go up that much. The end result is the mining sector tends to be expensive, with expectations of superstitious leverage priced-in.

In short, a lot of investors in the mining sector forget about valuation and invest on what looks attractive—Kim Kardashian effect—instead of what offers value. The end result is that the mining sector is a value destroyer—it consumes more investor money than it pays out in dividends. The fountainhead of this value destruction are the investors who “invest” superstitiously and based on linear thinking.

With quite legitimate macro-views on our politics and economics (money printing by the Fed, oppressive regulations, increase in a culture of entitlements, etc.), a lot people start making specific, fine-tuned predictions (gold going to the moon, US dollar crashing, for example) about the future. They forget that the world is too complex, with too many movable parts to make such specific predictions.

When it comes to equities, it is best to use spot price of metals to do valuations. If you are bullish on a metal just buy that metal or a proxy for that metal—see the above charts for possible proxies.

As I always use spot prices for my valuation, low-grade projects (supposedly, but often not, offering leverage) are mostly of no interest to me. Also, despite that I am very bullish on gold, in my view gold-equities have gone too far ahead of themselves, having now priced-in huge increase in gold price. This makes me very defensive in my investment approach.

For now, I am keen on gold companies that have not performed with other gold equities. Novo Resources (NVO) about which I want to talk about hasn’t; it hasn’t in my view because of lack of liquidity.

I have followed NVO and the work of its CEO, Dr Quinton Hennigh, for almost a decade. He was behind expanding resources at Springpole project, to 5.5 million ounces, when it was with Gold Canyon (an Akiko Levinson company, in which I was a Director).

Dr Hennigh is among the best combination of geology and financial astuteness I have seen in the sector. For me, management is the key.

NVO currently has a small resource, with very good grade for open-pit mining. Moreover, capital expenses should be very low, for all they need initially is a gravity circuit. To finalize their PEA, they are currently undertaking a bulk sampling program. If all goes well, they could be in production next year. They have also recently acquired a new project—Blue Spec—whose grades are outstanding. They are about to start drilling a zone that was missed by the prior operator.

NVO’s high-grade (albeit with a small-resource) flagship project and another very high-grade project they have recently acquired, and their tight share structure means that I personally took a large chunk of their recently closed financing, at $0.85.

Gold equities are in general overvalued. In my view they will fall. NVO will likely suffer as well. That is one good reason not to chase—it is actually never good to chase anyway. If NVO falls, at $0.85 it could be a very good buy.

Finally, I gave a speech on whether India is the next China at the last Mines & Money show in HK. This resulted in a lot of heated debate. At the next Mines & Money show in London, I will be debating on why I am extremely negative about India and why I think it will eventually fall apart, into smaller countries before there is a hope.

Warm regards,

Jayant Bhandari

Disclaimer: All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. The sole purpose of these musings is to show my thinking process when analysing a stock, not to provide any recommendation. I will not and cannot be held liable for any actions you take as a result of anything you read here. Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.

|

|

Latest News—20th August 2016 |

|

► |

|

|

|

Please enter your email to subscribe: |